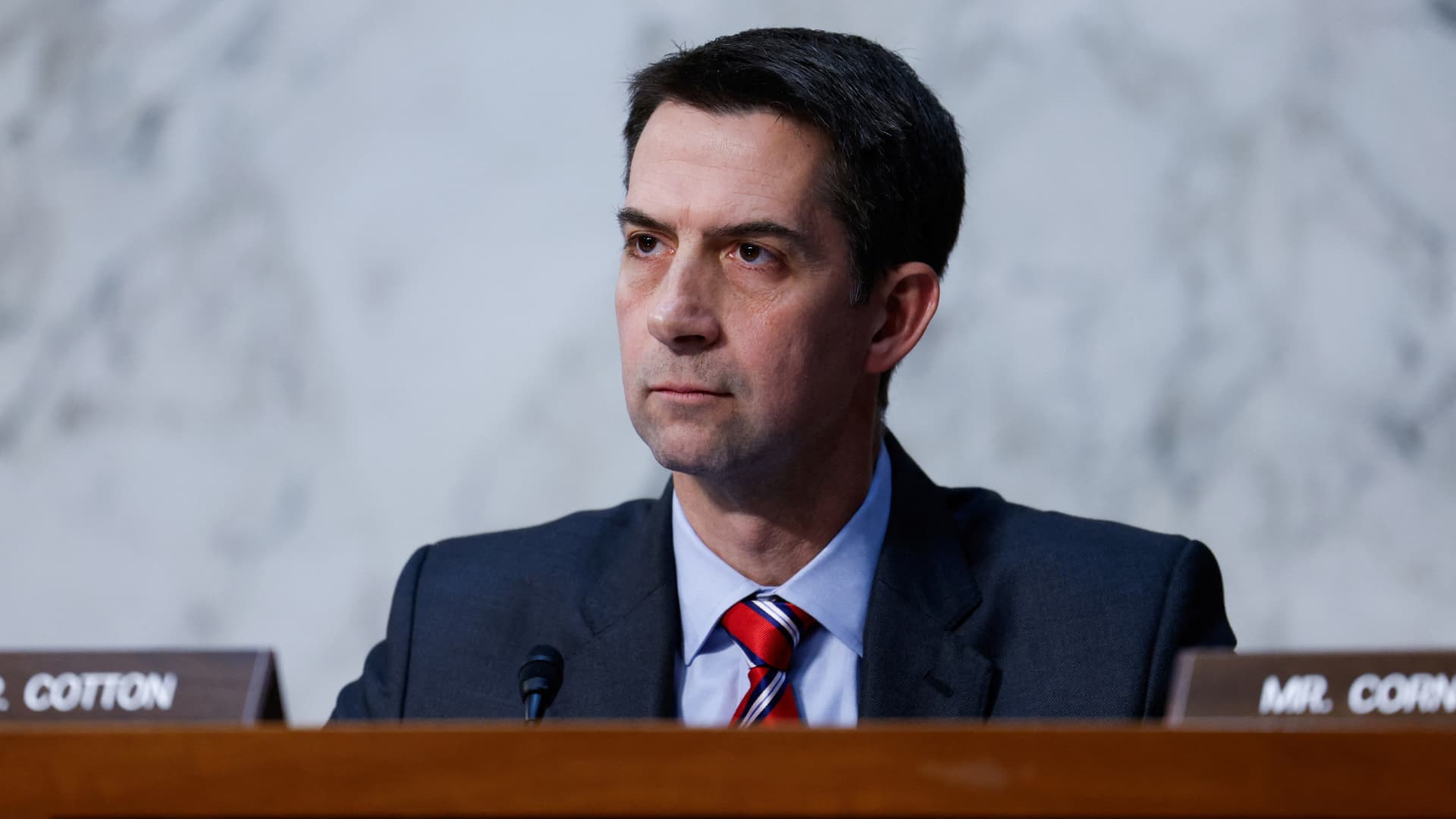

Devyani Worldwide which has the identical franchise of KFC, Pizza Hut, and many others., much like Sapphire Meals is obtainable at Rs 18,000 crore market cap. Picture: Reuters

Devyani Worldwide which has the identical franchise of KFC, Pizza Hut, and many others., much like Sapphire Meals is obtainable at Rs 18,000 crore market cap. Picture: ReutersKFC and Pizza Hut operator Sapphire Meals India’s IPO has been subscribed 1.5 occasions to this point with the ultimate day bidding nonetheless on. Sapphire Meals India IPO has to this point obtained bids for 1.18 crore fairness shares, towards a proposal measurement of 96.63 lakh shares. The retail investor portion has been subscribed 6.16 occasions; the non-institutional investor portion is undersubscribed at 34 per cent; and the certified institutional consumers’ portion has been subscribed solely 3 per cent to this point. Analysts say Sapphire Meals is similar to Devyani Worldwide by way of enterprise and types.“The corporate did a preferential allotment at Rs 505 simply 2 months again and now IPO at Rs 1,180. This doesn’t encourage confidence,” Aditya Kondawar, COO, JST Investments, instructed Monetary Specific On-line.

Sapphire Meals, arrange in 2015, is without doubt one of the Yum model’s restaurant operators within the Indian subcontinent. “Devyani Worldwide which has the identical franchise of KFC, Pizza Hut, and many others., much like Sapphire Meals is obtainable at Rs 18,000 crore market cap on Rs 1,100 crore income. Sapphire with virtually the identical income is developing at Rs 7,500 crore of market capitalisation. There’s a good probability of itemizing positive aspects as one thing has been left on desk for the traders as in comparison with its listed friends,” Rajesh Singla, Founder & CEO, PreIPO consulting agency Planify Consultancy, instructed Monetary Specific On-line.

Sapphire Meals’ preliminary public providing is completely offer-for-sale (OFS) of 1.75 crore fairness shares by promoters and current shareholders. The corporate has mounted a worth band of Rs 1,120-1,180 per fairness share. Within the main market, Sapphire Meals India shares have been quoting at a premium of Rs 55 apiece. On Thursday, shares have been seen buying and selling at Rs 1,235, a premium of practically 5 per cent.

Sapphire Meals has seen losses prior to now few intervals (FY19-20) and the financials haven’t been nice, nevertheless prior to now two intervals the loss has lowered, stated an analyst. The QSR area is anticipated to have a brilliant future prospect within the nation as a consequence of its cash-generating capability and its working capital cycle. “The IPO is valued at 60.2x FY21 EV/EBITDA and seven.3x FY21 EV/gross sales, which appears to be like to be at a modest low cost in comparison with the recently-listed Devyani Worldwide, which seems affordable because of the higher margins profile of Devyani. Quick meals tradition below QSR is anticipated to flourish in India as a consequence of a rise within the working-class inhabitants and continued urbanization. Therefore, traders can subscribe to it on a long-term foundation,” Likhita Chepa, Senior Analysis Analyst at CapitalVia World Analysis, instructed Monetary Specific On-line.

(The inventory suggestions on this story are by the respective analysis analysts and brokerage companies. Monetary Specific On-line doesn’t bear any accountability for his or her funding recommendation. Capital markets investments are topic to guidelines and rules. Please seek the advice of your funding advisor earlier than investing.)

Get stay Inventory Costs from BSE, NSE, US Market and newest NAV, portfolio of Mutual Funds, Try newest IPO Information, Greatest Performing IPOs, calculate your tax by Earnings Tax Calculator, know market’s High Gainers, High Losers & Greatest Fairness Funds. Like us on Fb and observe us on Twitter.

![]() Monetary Specific is now on Telegram. Click on right here to hitch our channel and keep up to date with the most recent Biz information and updates.

Monetary Specific is now on Telegram. Click on right here to hitch our channel and keep up to date with the most recent Biz information and updates.