The final insurance coverage business has ended the fiscal FY24 with 13 per cent progress. However, FY24 progress is decrease than when put next with 16 per cent achieved within the earlier 12 months.

Nevertheless, the business has maintained its double-digit progress development over the previous couple of years.

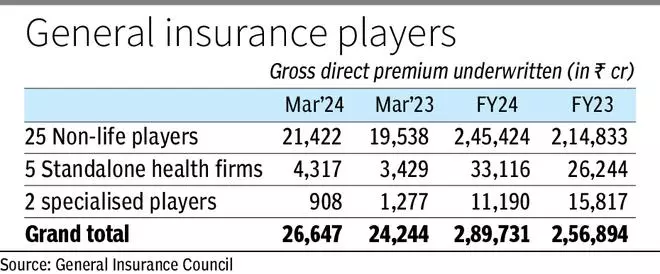

The gross direct premium for all non-life firms in 2023-24 elevated to ₹.2,89,731 crore from ₹.2,56,894 crore in 2022-23, in response to the info of the Normal Insurance coverage Council.

The gross premium of 25 non-life insurance coverage firms grew about 14 per cent at ₹.2,45,424 crore FY24 when put next with ₹2,14,833 crore in FY23, whereas for the 5 standalone well being insurers, gross direct premium grew 26 per cent at ₹33,116 crore as in opposition to ₹26,244 crore.

Two specialised insurers – Agriculture Insurance coverage Co of India Ltd and ECGC – reported a decline of 29 per cent of their mixed gross premium at ₹11,190 crore in FY24 (₹15,817 crore in FY23).

The non-life business continues to be pushed primarily by the well being and motor insurance coverage segments although it was marginally subdued in FY24 as a result of a fall in legal responsibility, crop insurance coverage and marine cargo, whereas hearth and credit score assure segments reported subdued progress numbers in comparison with final 12 months, in response to a current report of CareEdge Rankings.

Non-life section

PSU participant New India, high participant within the non-life section, reported a decline in its market share to 12.78 per cent in FY24 from 13.42 per cent in FY23 amid single-digit progress in its gross direct premium at ₹37,035 crore (₹34,483 crore in FY23). Oriental Insurance coverage Firm Ltd has managed to develop its share to six.31 per cent from 6.08 per cent whereas United India Insurance coverage Firm reported a marginal decline in its share to six.85 per cent from 6.87 per cent. Nationwide Insurance coverage Firm additionally reported a fall in it share to five.24 per cent from 5.90 per cent as its premium was flat in FY24.

ICICI Lombard, the second largest participant within the non-life section and the highest participant within the personal section, managed to develop its share from 8.18 per cent to eight.55 per cent, supported by 18 per cent rise in premium. The second large participant within the personal section HDFC Ergo reported a decline in its share to six.41 per cent from 6.48 per cent.

Within the standalone well being area, Star Well being maintained its high place and its gross premium earnings stood at ₹15,251 crore in FY24 when put next with ₹12,952 crore in FY23, a rise of 18 per cent. Star Well being’s market share elevated to five.26 per cent within the total non-life section, up from 5.04 per cent in FY23. Within the standalone well being class, its market share was 46 per cent in FY24, down from 49 per cent in FY23.

“The Indian non-life insurance coverage market will develop at 13-15 per cent within the medium time period. The business’s progress will likely be primarily pushed by the well being and motor insurance coverage segments, supported by rising disposable earnings ranges and an increase throughout different segments,” mentioned CareEdge.