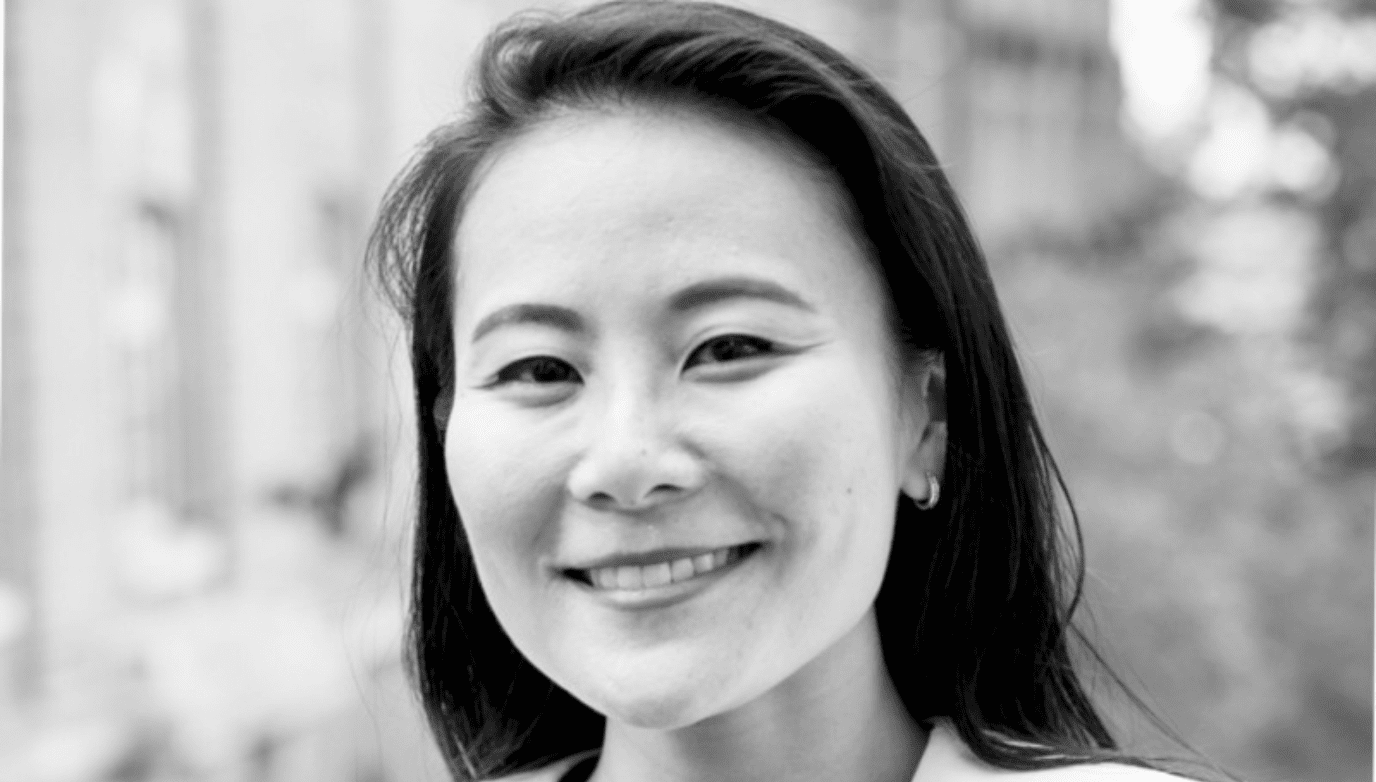

Gwendolyn Regina

Gwendolyn Regina has joined as an funding director at Binance to move its new US$100-million Binance Sensible Chain (BMC) fund.

The BMC fund, introduced final 12 months by Binance founder and CEO Changpeng Zhao, goals to empower rising initiatives and drive collaboration between centralised finance (CeFi) and decentralised finance (DeFi).

“Excited to announce that I’ve joined Binance to steer investments of the Binance Sensible Chain US$100M fund (denominated in fiat however distributed in crypto),” Regina stated in a LinkedIn submit.

Regina has 16 years of expertise within the media and know-how startup business throughout Asia Pacific, Paris, and Silicon Valley. She was most not too long ago an intrapreneur at Fb, build up a brand new enterprise unit of VC partnerships and startup progress. Earlier than that, she was entrepreneur-in-residence at Entrepreneur First, primarily based in Paris.

Beforehand, Regina constructed and offered tech media startup SGEntrepreneurs to Tech in Asia. She was additionally a founding crew member of Thymos Capital, an early-stage know-how funding agency in Singapore. She additionally spearheaded Mashable’s enlargement into Asia.

Regina is an alumnus of the Nationwide College of Singapore.

Additionally Learn: Extra troubles for Binance because the startup ordered to stop operations in Malaysia

“I used to be thoughts blown the primary time I noticed Bitcoin in 2010; I believed to myself, ‘that is how cash must be moved and that is how the world ought to collaborate’. A couple of years in the past, at the start of my sabbatical, I attempted to do a startup on this house specializing in identification, however it didn’t work out. Now 4 years later, I’m lastly full-time within the house,” she famous within the LinkedIn submit.

As an early-stage VC agency, the BMC fund gives US$100,000 in funding. It should additionally present liquidity assist for DeFi initiatives that move safety audits and the due diligence course of.

Chosen startups may also get assist from Binance’s assets, together with entry to hundreds of thousands of shoppers, media info within the ecosystem, information training, incubation financing, derivatives, monetary administration, and different complete assets and monetary assist. Excessive-quality initiatives have a chance to take part to be listed on Binance.

Except for the US$100 million fund, BMC has additionally launched a Token Canal undertaking, by which it’s working with the Binance Sensible Chain neighborhood to assist builders join the Binance Sensible Chain with different public chains. By means of the safe custody service of the Binance CeFi platform, tokens on different public chains could be related to the Binance Sensible Chain, together with BTC, ETH, and different ERC20 tokens (LINK, USDT, DAI, and extra), in addition to XPR, BCH, LTC, ADA, DOT, XTZ, EOS, ONT, and so on.

Additionally Learn: How Binance acquired 35 per cent market share in a 12 months with its new crypto derivatives line

“Some dismiss blockchain applied sciences as ‘simply one other tech’. I might argue you’re half proper. We would like it to be ‘simply one other tech’ sometime. But it surely’s not now. It has opened up totally different prospects for the way we are able to do issues and foreshadows how society will proceed to be formed. Once you lower the world’s collaboration prices, extra superb issues can occur,” Regina added. “Thrilled to be main the BSC Fund and ambitiously, to play an element in bringing extra prospects to our future.”

Binance has been beneath immense strain from the market regulators of assorted international locations throughout the globe. Final month, Malaysia’s Securities Fee took motion in opposition to the cryptocurrency alternate for illegally working within the nation. This adopted authorized actions in opposition to the corporate by a number of international locations, together with Italy, Germany, Poland, Japan, Thailand, Singapore, the US, and the UK.

The submit Gwendolyn Regina to steer investments at Binance’s new US$100M DeFi fund appeared first on e27.